As a parent, life insurance is one of the most important things you can purchase for your family. Not only does it provide financial protection in the event of your death, but it can also give your children a head start in life. However, life insurance for children can differ slightly from life insurance for adults. Here are four things you need to know before buying life insurance for your children.

Table of Contents

1 – What Are The Benefits Of Life Insurance For Children?

Many people might not see the need for life insurance for children. After all, they are young and healthy and have their whole lives ahead of them.

- However, the purpose of life insurance for children is not to pay off debts or final expenses. Rather, its purpose is to provide financial security for your family in the event of an untimely death.

- No one knows what the future holds, and accidents can happen at any age. With life insurance for children in place, you can rest assured knowing that your child’s arrangements will be taken care of financially.

- It can also be used as a long-term savings mechanism, as these policies typically include a cash value and grow over time. (source)

2 – What Are The Different Types Of Life Insurance For Children?

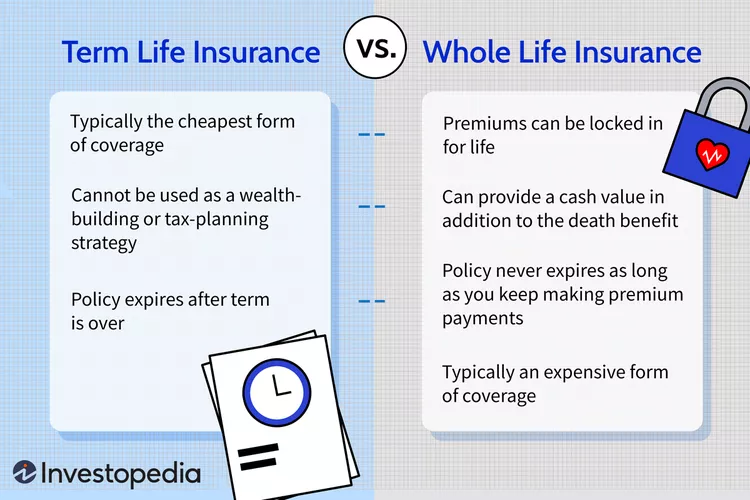

Just like adults, children need life insurance. But what kind of life insurance is best for them? There are two main types of life insurance for children: whole life and term life.

- Whole life insurance provides coverage for the insured child’s entire lifetime, as long as premiums are paid. Most insurers will transfer ownership of a whole life policy automatically from a parent, grandparent, or guardian, to the insured child once they turn 18 or 21. (source)

- Term life insurance, on the other hand, only provides coverage for a specific period of time, after which the policy expires. “Like other types of life insurance, term life insurance starts with an application for coverage with an insurance company. Once a policy is in force with the company, you pay monthly, quarterly or annual policy premiums to maintain coverage. If you die during the specified policy term, the insurance company pays the specified death benefit amount to your named beneficiaries.” (source)

So which one is right for your child? Whole Life or Term Life

It depends on your individual circumstances. If you want to provide lifelong protection for your child, whole life insurance may be the way to go.

But if you’re looking for a more affordable option, term life insurance may be better. Whichever type of life insurance you choose, make sure you shop around and compare different policies before making a decision.

And most importantly, make sure you purchase enough coverage to financially protect your child in case of an unforeseen event.

3 – How Much Coverage Does A Child Need?

While there’s no one-size-fits-all answer to this question, as the amount of life insurance coverage a child needs will vary depending on factors such as the family’s financial situation and the child’s age, some general guidelines can be followed.

To give your child a healthy amount of financial security, you might consider $25,000 to $50,000 in coverage – The more coverage you buy, the bigger the policy’s cash value can become.

Additionally, it is important to consider the cost of any future expenses, such as college tuition or wedding costs, when determining how much coverage to purchase. By considering these factors, parents can ensure that their children have the coverage they need.

4 – What If My Child Has A Pre-existing Medical Condition?

If you’re like most parents, you want to do everything you can to protect your children. That includes making sure they have a solid financial foundation should something happen to you. One way to do that is by taking out a life insurance policy in their name.

But what if your child has a pre-existing medical condition? Can you still get life insurance for them?

The good news is that, in most cases, the answer is yes.

There are a number of life insurance companies that offer policies specifically for children with pre-existing medical conditions. And while the premiums may be higher than for a standard policy, they’re still typically very affordable. Many families find that the peace of mind that comes from knowing their child is protected financially is well worth the cost.

So if you’re concerned about your child’s financial future, don’t let a pre-existing medical condition stand in your way. Plenty of options are available to ensure they’re taken care of no matter what happens.

Recap: Choosing Life Insurance For Your Children

Life insurance for children can be a valuable tool to help provide financial security for your loved ones. By understanding the different types of coverage and how much your child will need, you can ensure you get the best life insurance policy for your family. We will be happy to help you find the best policy for you and your family. Contact us today for a free quote.