Let’s be real—closing one sale feels good. Watching your client finally exhale, knowing they’re protected? That’s what we live for.

But if you’re in this for the long haul—if you’re building a career that protects other people’s futures while securing your own—you need more than feel-good milestones. You need data that keeps you focused, sharp, and growing.

At SN Agency, we don’t believe in hustle for hustle’s sake. We believe in meaningful growth. So if you’re ready to stop throwing spaghetti at the wall and start seeing consistent results, here are five sales metrics every life insurance agent (new or experienced) should be tracking.

Table of Contents

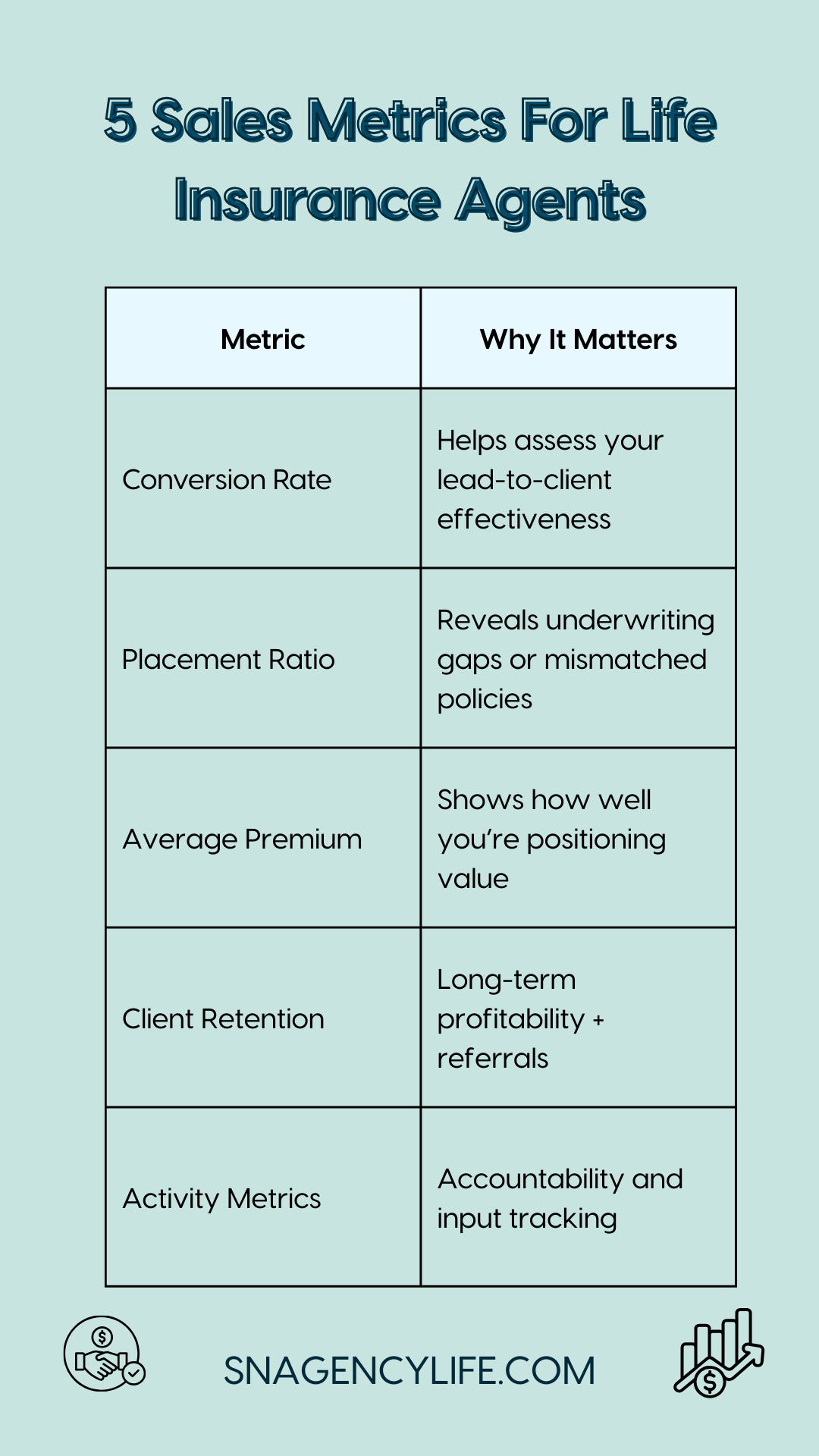

🔢 1. Conversion Rate – Because Connection Isn’t the Goal. Commitment Is.

Your conversion rate tells you how many leads are actually turning into clients.

This isn’t just a number. It’s feedback:

- Are your conversations resonating?

- Is your process too rushed—or too drawn out?

- Are you attracting the right kind of leads?

Want better conversions? Focus on improving your story. Get tighter with your follow-up. And identify which lead sources are actually worth your energy.

Pro tip: Track separate conversion rates for each lead type—warm referrals vs. online leads vs. cold outreach. You’ll learn fast where your sweet spot is.

📦 2. Policy Placement Ratio – Because Submitting an App Isn’t the Same as Getting Approved

Your placement ratio is the number of submitted applications that actually become active, enforceable policies.

If this number is low, it’s not always about the client—sometimes it’s about you:

- Are you helping clients pick the right product?

- Are your apps complete and underwriter-friendly?

- Are there better fits across your carrier options?

Improving this metric is usually about slowing down to speed up—better discovery, better solutions, better outcomes.

💰 3. Average Premium Size – Because Volume Without Value Isn’t Sustainable

This one’s often overlooked but speaks volumes.

Your average premium per policy tells you not just how much you’re selling—but how confidently you’re presenting real, comprehensive protection.

- Are you underselling to “just get the deal”?

- Are you educating clients on layered coverage?

- Are you showing them the cost of not being protected?

Increasing premium size isn’t about upselling—it’s about believing in the solution you’re offering.

Maybe it’s time to deepen your product knowledge, focus on more robust policy types, or position premium as peace of mind (not pressure). Maybe your families deserve more than the most affordable option.

🔁 4. Client Retention Rate – Because It’s Cheaper to Keep a Client Than to Find a New One

This number isn’t sexy, but it’s powerful.

Keeping clients year after year means:

- You built trust.

- You delivered value.

- You maintained connection.

📈 According to Harvard Business School, a 5% increase in client retention can lead to a 25%–95% increase in profitability.

Let that sink in.

Want your retention rate to rise?

- Send check-ins on anniversaries.

- Offer seasonal coverage reviews.

- Give human follow-up, not just automated texts.

You don’t need tech to build trust. You need heart and consistency.

📞 5. Weekly Activity Metrics – Because You Can’t Manage What You Don’t Measure

Let’s talk effort.

Are you tracking:

- Weekly calls made?

- Appointments held?

- Virtual or in-person presentations delivered?

These activity metrics tell the truth—especially when your conversions stall. If your results are down but your calls are up? It’s time to tweak your messaging. If activities are low? Time to get back in the rhythm.

Don’t wing it. Dial into what moves the needle, and create minimum baseline activity goals.

“We don’t rise to the level of our goals—we fall to the level of our systems.” – James Clear

Your numbers become your accountability partner. Don’t fear the data. Use it to stay focused and fueled.

✨ You’re Not Just an Agent. You’re a Builder.

You’re building a business. A brand. A reputation. A legacy.

These five metrics aren’t just for spreadsheets or some leaderboard. They help you measure impact. They remind you what’s working—and where to fine-tune.

So don’t let success stay vague.

Track it.

Take ownership of it.

And use it to build something that lasts.

Related Articles:

How to Sell Life Insurance and Build Long-Term Passive Income Streams

Quick Recap:

🧭 Ready to Level Up Your Metrics (and Your Mission)?

If you’re serious about taking your life insurance career beyond “just enough” and into legacy-level growth…

👉 Let’s talk goals, strategy, and how we track success together.

Schedule a discovery call here »