Let’s be honest—life insurance can be confusing. All the jargon, numbers, and policy types can make your head spin, especially if you’re trying to make the right choice for your family’s future or financial goals.

At SN Agency, we believe in cutting through the noise. So let’s break down one of the most common questions in life insurance:

What’s the difference between Term Life Insurance and Whole Life Insurance?

In simple words…

Let’s explain both, compare the pros and cons, and help you figure out which one might be right for you.

Table of Contents

📍 First, What Is Life Insurance?

Life insurance is a contract between you and an insurance company. You pay a monthly or yearly premium, and in return, the company promises to give a lump-sum payout (called a death benefit) to your chosen person(s) when you pass away.

This money helps your loved ones:

- Pay for final expenses

- Cover day-to-day bills

- Pay off debt

- Fund education

- Build long-term financial security

🚪 Term Life Insurance – “Coverage for a Set Period”

Think of term life insurance like renting an apartment. You’re covered for a certain number of years—typically 10, 20, or 30 years.

🔑 Key Features:

- Cheaper monthly premiums

- Coverage ends after the term (unless renewed)

- Pays out only if you pass away during the covered term

- Does not build cash value

✅ Ideal For:

- Young families on a budget

- Individuals with temporary financial responsibilities (like a mortgage or kids in college)

- People who need basic, affordable coverage

➖ Drawbacks:

- Once the term ends, the coverage stops (unless you renew at a higher cost)

- No savings or investment benefit

🌳 Whole Life Insurance – “Coverage That Lasts for Life”

Now think of whole life insurance like owning a home. It’s permanent—you’re covered for your entire life, and part of your premiums go into a cash value account that grows over time.

🔑 Key Features:

- Lifelong coverage

- Builds cash value you can borrow from or withdraw

- Premiums are higher, but stay the same over your life

- Guaranteed death benefit, no matter when you pass

✅ Ideal For:

- People who want to build generational wealth

- Parents or grandparents planning their legacy

- Anyone who wants predictable, long-term financial planning

➖ Drawbacks:

- Higher monthly premiums

- Can be more complex to understand

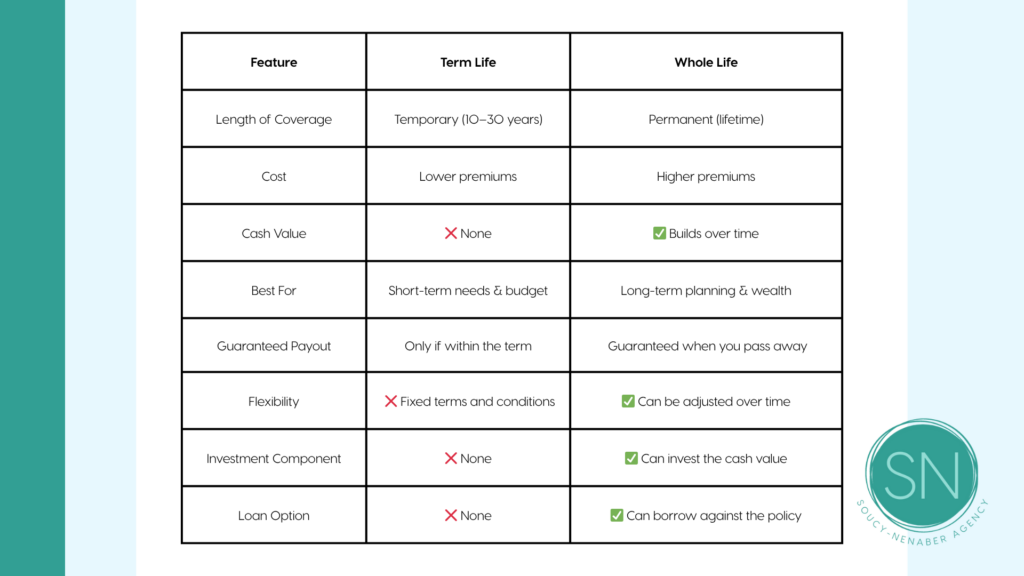

🆚 Term vs. Whole Life: Simple Comparison Chart

👣 Which One Should You Choose?

There’s no one-size-fits-all answer. The right type depends on your…

- Age

- Health

- Budget

- Family Responsibilities

- Long-Term Financial Goals

At SN Agency, we walk through all of this with you—no pressure, no judgment—so you can make the choice that truly fits your life.

💬 Real Talk: Term + Whole = Option, Too!

Here’s a little-known secret: you can mix both!

Many of our clients start with affordable term coverage while their family is growing, then add whole life later to build wealth, leave a legacy, and cover life-long responsibilities.

🎯 Get Clear on Your Coverage Today

Don’t let confusion keep you from taking care of your family. Whether you’re just getting started or need to reevaluate your current policy, we’re here to make life insurance make sense.

👉 Ready to explore your options?

Get a free quote or schedule an easy, no-pressure chat with someone from the SN Agency team.

We’re not just selling policies—we’re building relationships, legacies, and peace of mind.