Let’s clear the air:

Yes. You absolutely can have more than one life insurance policy.

And in many cases?

You should.

At SN Agency, we speak with families and individuals who are just trying to get it right—to protect what matters most. But too often, they’ve been told that one life insurance policy is all they’re “allowed” to have.

That’s not just wrong—it’s dangerous advice when you’re building a legacy or shielding your family from financial chaos.

So let’s break this down clearly and honestly.

Table of Contents

💡 Why Someone Might Want More Than One Policy

This isn’t about overcomplicating your finances.

It’s about tailoring your coverage to what your family really needs—today and ten years down the road.

Here are three common reasons people hold multiple life insurance policies:

1. They’re stacking coverage for different life stages

You may take out a 20-year term to cover the mortgage…

And pair it with a small permanent policy that builds cash value for retirement or estate planning.

Each one has a job.

2. They’ve outgrown their first policy

Maybe you got a $250,000 policy in your 20s. Great start.

But now you’ve got two kids, a growing income, and more responsibilities.

Instead of canceling that one, it can make more sense (and save you money) to layer on a second policy.

3. They’re a business owner, caregiver, or breadwinner

If your family depends on your income or you carry business debt, it’s smart to match your overall risk exposure with the right amount of coverage.

🚫 What You Need to Watch For

Just because the answer to “Can I have more than one life insurance policy?” is yes… doesn’t mean piling on policies without a strategy is wise.

Here’s what to keep in mind:

- Insurance companies will ask for details on any existing policies during the underwriting process.

- Coverage amounts are based on your income and financial need — so you can’t insure yourself for wildly unrealistic amounts just to multiply payouts.

- Always work with a licensed, ethical agent (like here at SN Agency) who designs a full protection plan, not a random patchwork.

More isn’t always better—but the right combo is powerful.

🧠 Strategy Over Stacking

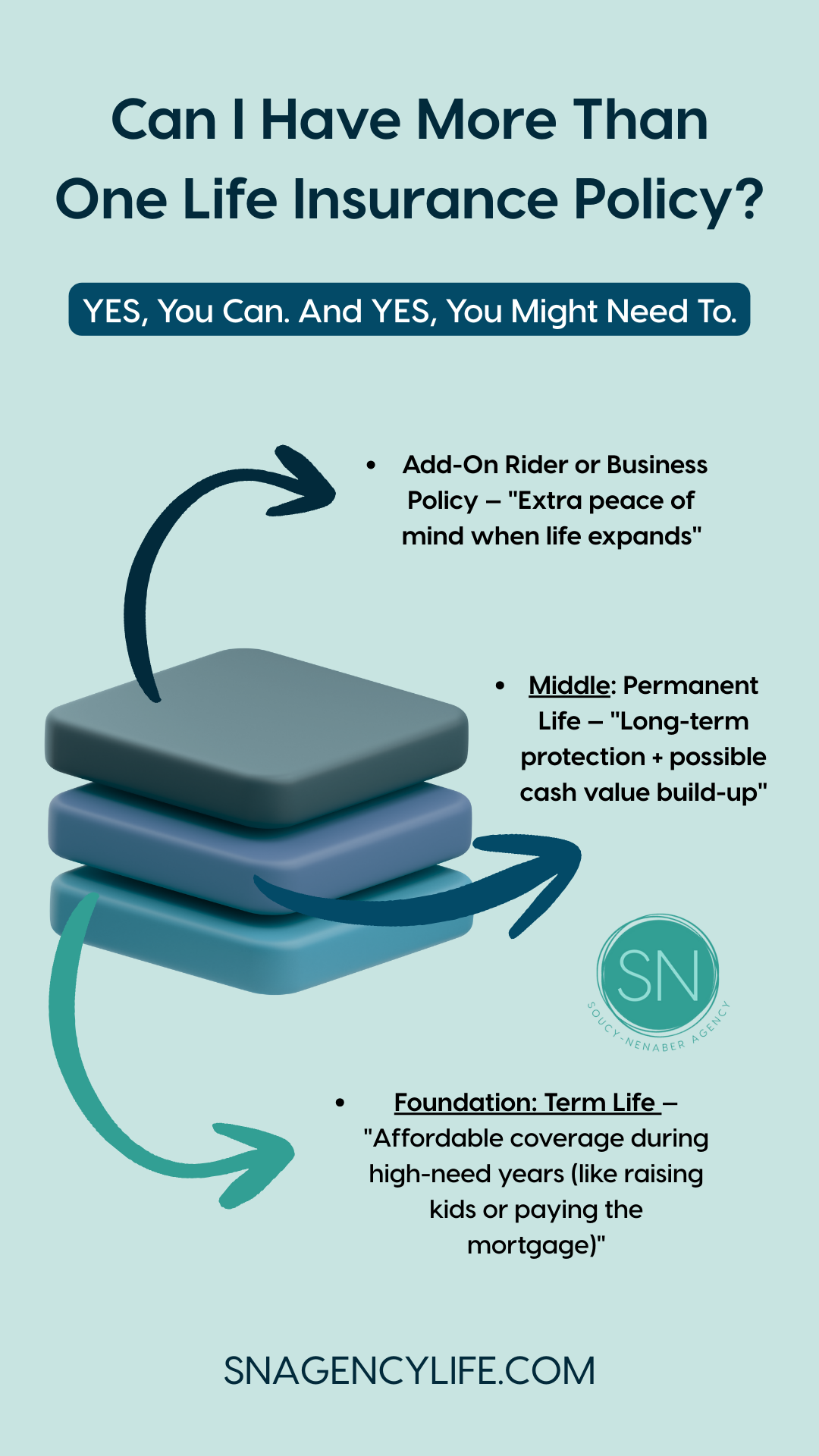

Think of it like building a house.

One policy might be the foundation. Another supports the roof. A third could protect your long-term investments.

Each piece matters. But it only works if the blueprint is sound.

Our job at SN Agency isn’t to sell you more policies—it’s to help you create a structure that stands the test of time.

👇 So… Should You Have More Than One Life Insurance Policy?

That depends on your answer to one big question:

👉 If something happened to you tomorrow… would one policy be enough to truly give your spouse, kids, or parents the time, space, and stability they’d need to rebuild?

If you’re not 100% sure…

Let’s chat.

👣 Next Steps:

- 💬 Book a Free Life Insurance Strategy Call → We’ll assess your existing coverage and gaps.

- 📊 Get a Customized Plan → Whether it’s one powerful policy or a layered structure, we’ll guide you.

- 🙏 Feel the Peace of Knowing They’re Protected → Not just for today, but for the future.

Your family’s future isn’t one-size-fits-all. Your life insurance shouldn’t be either.

You can have more than one life insurance policy.

You just need someone who sees the full picture—and knows how to protect it.

👉 Schedule Your Consultation Now

We’ll help you build coverage that fits your life.