Thinking about a career shift can feel overwhelming, especially when you’re venturing into unfamiliar territory. If you’ve been exploring the idea of becoming a life insurance agent, you might be asking yourself whether it’s the right fit for you. This article will help you evaluate your strengths, career goals, and values while highlighting insurance agent pros to determine if pursuing a career in life insurance aligns with your aspirations.

Table of Contents

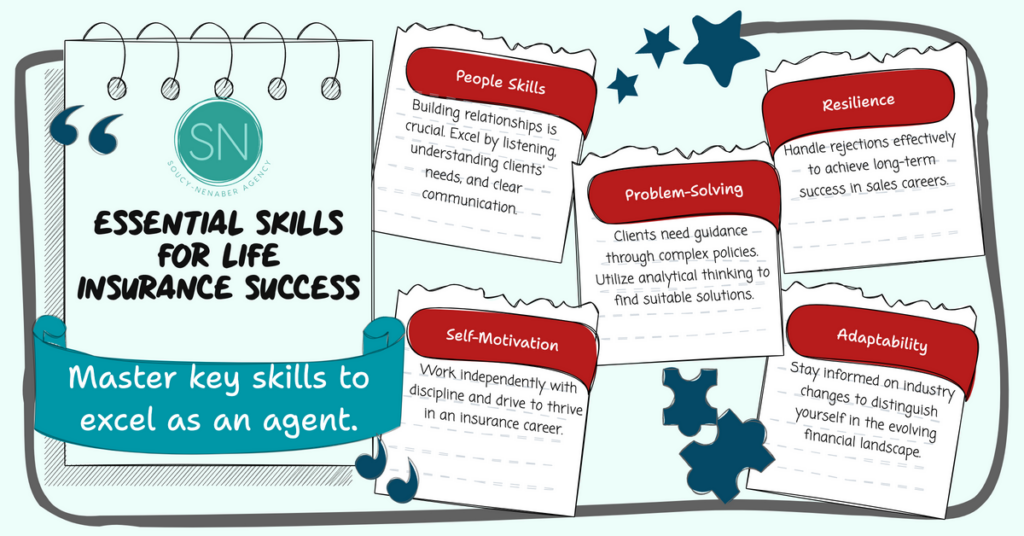

The Skills Needed for Success

Before jumping into any career, it’s critical to take a close look at the skills required to succeed. Here’s an overview of what makes a good life insurance agent:

- People Skills: Building relationships is at the heart of this job. You’ll thrive if you’re great at listening, understanding a client’s needs, and communicating clearly.

- Self-Motivation: Life insurance agents often work independently, so being disciplined and driven is essential.

- Problem-Solving: Clients will look to you to guide them through complex policy decisions. Analytical thinking will help you find the best fit for their unique situations.

- Resilience: Sales careers come with rejection. Having the ability to bounce back and stay positive is key to long-term success.

- Adaptability: The financial industry is constantly evolving. Agents who stay on top of trends and industry shifts set themselves apart.

Take a moment to reflect on your strengths. Do these skills align with how you see yourself? If so, you may already have a solid foundation for success in this role.

Taking Your Business From Good to Great: A Business Woman’s Guide to Earning More Money from Home

Life Insurance Agent Pros

One of the reasons life insurance is an attractive career path is because of the many perks it offers. Here are just a few:

- Flexibility: Say goodbye to the rigid 9-5 schedule. This career offers the flexibility to design a work-life balance that allows you to prioritize family, personal interests, or even traveling.

- Unlimited Earning Potential: With commissions tied to performance, the harder you work, the more you earn. Top agents can bring in lucrative incomes, making it a highly rewarding career financially.

- Making a Difference: This isn’t just a sales job—life insurance agents help families secure financial stability and peace of mind for the future. It’s a career with significant impact.

- Career Growth Opportunities: With the right work ethic, you can progress into leadership roles, grow your own team, or even start your own agency.

- Low Barrier to Entry: Compared to many industries, becoming a life insurance agent doesn’t require years of educational training. Many companies, like SN Agency, offer comprehensive support and training to get you started.

The Top 4 Reasons: Why Become a Life Insurance Agent

4 Challenges to Consider

What is the disadvantage of an insurance agent? While there are many benefits, it’s also important to acknowledge the potential challenges of the job:

- Starting Out Can Be Tough: The initial months can feel like an uphill climb as you build your client base and refine your sales approach.

- Commission-Based Pay: This model means your income might vary, especially in the early stages. Budgeting and financial planning will be important.

- Handling Rejection: Not every prospect will say yes. Building resilience and staying optimistic will help you thrive through the ups and downs.

- Learning Curve: Mastering the complexities of policies and licensing requirements takes time and effort.

Understanding these challenges ahead of time will help you prepare and assess whether you’re ready to work through them to achieve your goals.

What You Need To Know Before Becoming An Insurance Agent | Is It Worth It?

Is This Career Aligned with Your Personality and Aspirations?

Here are some questions to help you determine if this career aligns with your values and goals:

- Do you enjoy helping people solve problems and achieve their goals?

- Are you looking for a flexible career that allows you to control your schedule?

- Are you comfortable working in a performance-driven environment?

- Do you value financial independence and the ability to scale your income?

- Are you seeking personal growth and development opportunities in your career?

If your answers lean toward “yes,” becoming a life insurance agent may be an excellent fit for you. But if you’re still unsure, take time to research further, speak with current agents, and even shadow someone in the field.

Choosing the Right Agency

Your success as a life insurance agent also depends on the support and culture of the agency you choose. At SN Agency, for example, agents benefit from a positive, empowering environment, comprehensive training, and the freedom to design their ideal work-life balance. Joining a company that aligns with your vision and values will make all the difference in your success.

Final Thoughts: Insurance Agent Pros

Choosing a career in life insurance is a personal decision that requires honest self-reflection. It’s about understanding your strengths, goals, and willingness to overcome challenges. The role isn’t just a job—it’s an opportunity to make a tangible difference in people’s lives while achieving your personal and professional goals.

If you think this career could be the right choice for you, take the next step. Explore training opportunities, connect with an agency like SN Agency, and see how this path can open doors to a fulfilling, flexible, and impactful career. Start Here!