When it comes to choosing a career, most people dream of financial stability, work-life balance, and doing work that feels meaningful. What if there was a way to achieve all three while also creating a steady stream of passive income?

Selling life insurance isn’t just a job—it’s a chance to help others, grow personally and professionally, and gain financial freedom. By learning how to sell life insurance effectively and embracing the opportunities for passive income, you can truly transform your career and your future.

This article will show you how to:

- Build a successful life insurance sales career.

- Unlock passive income streams for long-term financial independence.

- Position yourself as a trusted resource for clients while living life on your own terms.

Ready? Let’s dive in.

Table of Contents

Why Life Insurance Sales is a Game-Changer

Selling life insurance isn’t just about policies or paperwork—it’s about empowering families. You’ll be helping clients secure their futures and protect what matters most to them.

Here’s why life insurance sales is the ultimate career choice:

- Unlimited Earning Potential: Your income is based on sales commissions. The more policies you sell, the more you earn, with no cap on your potential.

- Passive Income Opportunities: Life insurance agents can earn residual commissions, providing ongoing income from policies already sold.

- Flexibility and Freedom: You can take control of your schedule, work from anywhere, and achieve a healthy work-life balance.

- Making a Difference: You’ll have the chance to give families peace of mind, ensuring they’re financially secure during life’s ups and downs.

By learning to sell life insurance strategically, these benefits can be more than dreams—they can become your reality.

How to Sell Life Insurance Effectively in 4 Steps

Mastering the art of life insurance sales starts with understanding the needs of your clients and positioning yourself as a trusted guide. Here’s how you can thrive in this industry:

1. Start with Empathy

Life insurance is a deeply personal product—it’s about providing financial security in uncertain times. To connect with your prospects:

- Ask open-ended questions to understand their needs, fears, and goals.

- Show you care by focusing on how a policy will benefit their loved ones.

- Create trust by being transparent about their options and avoiding pushy sales tactics.

2. Educate Your Clients

Many people don’t fully understand the value of life insurance or how it works. By acting as an advisor rather than a salesperson, you can add value and position yourself as a resource.

- Break down complex terms into simple language.

- Use real-life examples to explain how life insurance protects families.

- Address their concerns honestly, showing you’re invested in their future.

3. Leverage Your Network

Success in life insurance sales often comes from building strong relationships:

- Reach out to family, friends, and acquaintances who may benefit from your services.

- Use referrals as a key part of your strategy. Happy clients often recommend their agent to others.

- Network within your community to establish credibility and connect with potential clients.

4. Invest in Personal Development

Selling life insurance requires strong communication, resilience, and confidence. Continually work on skills that will set you apart, such as:

- Mastering sales training techniques.

- Developing active listening skills.

- Learning how to overcome objections effectively.

At SN Agency, we empower our agents with ongoing training, mentorship, and resources to help them succeed.

Building Long-Term Passive Income Streams

One of the most exciting aspects of selling life insurance is the ability to generate passive income over time. Here’s how it works:

What is Passive Income in Life Insurance Sales?

When you sell a life insurance policy, you typically earn an upfront commission. In addition to this, many policies offer renewal commissions—a percentage of the policy premium that you receive every year the client keeps the policy active.

What does this mean for you? Even if you step away from actively selling, you can continue to earn income on the policies you’ve already sold. Over time, this can create a steady and reliable source of income.

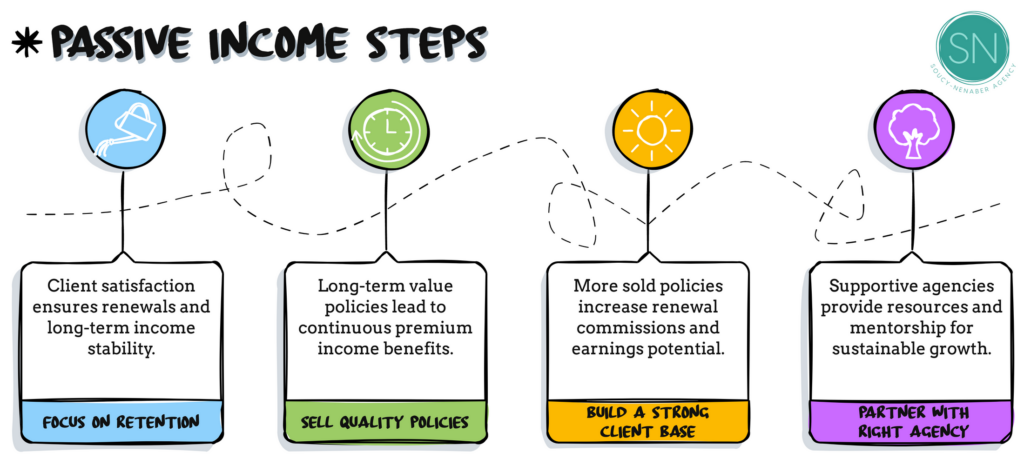

4 Steps to Build Your Passive Income:

- Focus on Retention: Client satisfaction is key. By providing excellent service, you’ll ensure clients are happy with their policies and renew them year after year.

- Sell Quality Policies: Offer policies that provide long-term value to clients, such as whole life or universal life policies, which often involve recurring premiums.

- Build a Strong Client Base: The more policies you sell, the more renewal commissions you can earn. Growing your book of business is critical for maximizing passive income opportunities.

- Partner with the Right Agency: Working with a supportive agency (like SN Agency) can provide you with the tools and mentorship needed to expand your client base and create sustainable income streams.

How SN Agency Helps You Succeed

At SN Agency, we understand that starting in life insurance sales can feel intimidating, but we’re here to set you up for success. Here’s what you get when you join our team:

- Training and Mentorship: Learn the art of selling and retaining clients from experienced professionals.

- Positive Work Culture: Experience a supportive, uplifting environment free from negativity and office politics.

- Growth Opportunities: Whether you want to work part-time or build a full career, our resources help you achieve your goals.

- Unparalleled Flexibility: Work when and where you want while prioritizing what matters most in your life.

At SN Agency, we don’t just help you sell life insurance—we help you create a fulfilling, purpose-driven career.

Ready to Build Your Future?

Selling life insurance is about more than just earning commissions—it’s about creating financial freedom, building strong relationships, and helping clients achieve peace of mind. By mastering sales, focusing on retention, and working with the right agency, you can turn your efforts into long-term passive income streams.

If you’re ready to take the next step, SN Agency is here to guide you every step of the way.

👉 Contact Us Today to Get Started

Your future of freedom, flexibility, and impact is just a decision away.