You’re sitting across from a young family, the kind that’s juggling soccer practices, late-night feedings, and dreams of a debt-free future. They need life insurance that fits their life—not some cookie-cutter policy from a single company that leaves gaps. But instead of scrambling or settling, you pull from a toolkit stacked with options from the industry’s heavy hitters. That’s not a dream. That’s your reality as a life insurance broker with SN Agency.

I’m Jamie (with Cory right beside me, as always), and we’ve built SN Agency from our own “before” stories—me as a nurse trading scrubs for freedom, Cory stepping away from school admin to chase something bigger. We know what it’s like to feel zapped by the 9-5 grind, craving a career that gives back as much as it gives you time and money. That’s why our model isn’t about locking you into one carrier. It’s about unlocking everything: flexibility to own your schedule, the joy of helping families sleep easier, and uncapped potential to build a legacy you can pass down. No warm-market pressure, no ad spend—just real relationships and real results, like the 586 recruits we’ve grown organically since day one.

As a life insurance agent, the company you partner with can make or break your path. But what if you didn’t have to choose between loyalty and liberty? At SN Agency, we hand you the keys to sell from all the top insurance companies. Think Mutual of Omaha’s rock-solid reliability, SBLI’s no-fuss affordability, Americo’s quick-close magic—and that’s just the start. You’re not tied down. You’re empowered to match clients with what truly fits, turning “What if?” into “We’ve got this.”

Let’s break it down: Why this broker model changes everything for you, your clients, and that fire in your gut for something more.

Table of Contents

What Does It Mean to Be a life insurance broker with SN Agency?

Picture the contrast. Three years ago, you might’ve been chained to a desk, pushing one company’s products like it was your only play—frustrating when a client’s needs didn’t line up. Now? As an SN Agency life insurance broker, you’re independent. Free. A true advisor, not a salesperson in disguise.

What does a broker do in life insurance? Here’s the real talk on what that looks like:

- More Options for Your Clients: Shop from a lineup of trusted carriers, so whether it’s term life for a starter family or indexed universal for legacy builders, you’ve got the perfect match.

- No Restrictions: Ditch the single-company handcuffs. Our commissions? Competitive across the board, with renewals that build your passive income stream—no cap, no catch.

- Higher Client Satisfaction: When you solve real problems (like that friend whose husband’s accident left them scrambling for funeral funds), trust skyrockets. Referrals? They roll in because you’ve earned them.

We don’t just say it—we live it. Our training pulls straight from the trenches: Understand your client’s fears (Secret #1 from our 5 Secrets guide), build rapport that feels like friendship (Secret #2), and articulate why this policy brings peace of mind (Secret #3). It’s not theory. It’s the system that’s helped our agents crush it, even without sales experience.

Access Products from the Top Insurance Companies as a life insurance broker

Here’s where the magic happens. As an SN Agency life insurance broker, your portfolio isn’t limited—it’s loaded. We partner with the best so you can serve everyone from first-time parents to high-net-worth planners. Dive in with these standouts:

1. Mutual of Omaha

The gold standard for trust. Their term, universal, and whole life options? Competitive rates that families love. Serve clients who want reliability without the runaround—perfect for that “secure their future” vibe so many of you crave.

2. SBLI (Savings Bank Life Insurance)

SBLI’s reputation for affordability and simplicity makes their products a fantastic choice for budget-conscious families. Their straightforward term, whole, and no-medical-exam life insurance options are a popular choice for first-time buyers.

3. Americo

Agent-friendly from the jump. Quick approvals and solid commissions mean you close faster, earn more, and keep that momentum. Innovation here at Americo means less hassle, more high-fives with clients.

4. Transamerica

Flexible for every stage—think IUL for growth or final expense for peace. Their stability? Ironclad. Ideal when you’re building toward financial independence while giving families the same.

5. AIG (American International Group)

A trusted name globally, AIG specializes in underwriting for high-risk clients, allowing you to serve individuals who may have been denied by other providers. Their guaranteed issue policies ensure you can meet unique and challenging client needs. Expand your reach—because saying “yes” to the underserved? That’s impact that sticks.

6. John Hancock

Wellness warriors with their Vitality Program—rewards for healthy habits baked right in. For the health-conscious crowd, it’s a game-changer that ties into your passion for growth and positivity.

7. Foresters Financial

Foresters Financial specializes in community-focused life insurance. Their family-oriented policies and member benefits—like scholarships and emergency grants—make them an excellent choice for middle-income families.

8. Lincoln Financial Group

For the big-picture players. Estate planning and tax smarts for complex needs. When clients dream of legacies, this levels you up as their trusted guide. For clients with complex financial needs, Lincoln Financial Group offers estate-focused and tax-efficient strategies. Their advanced offerings make them a go-to for high-net-worth clients.

Why is this Life Insurance Broker Business Model Better for You?

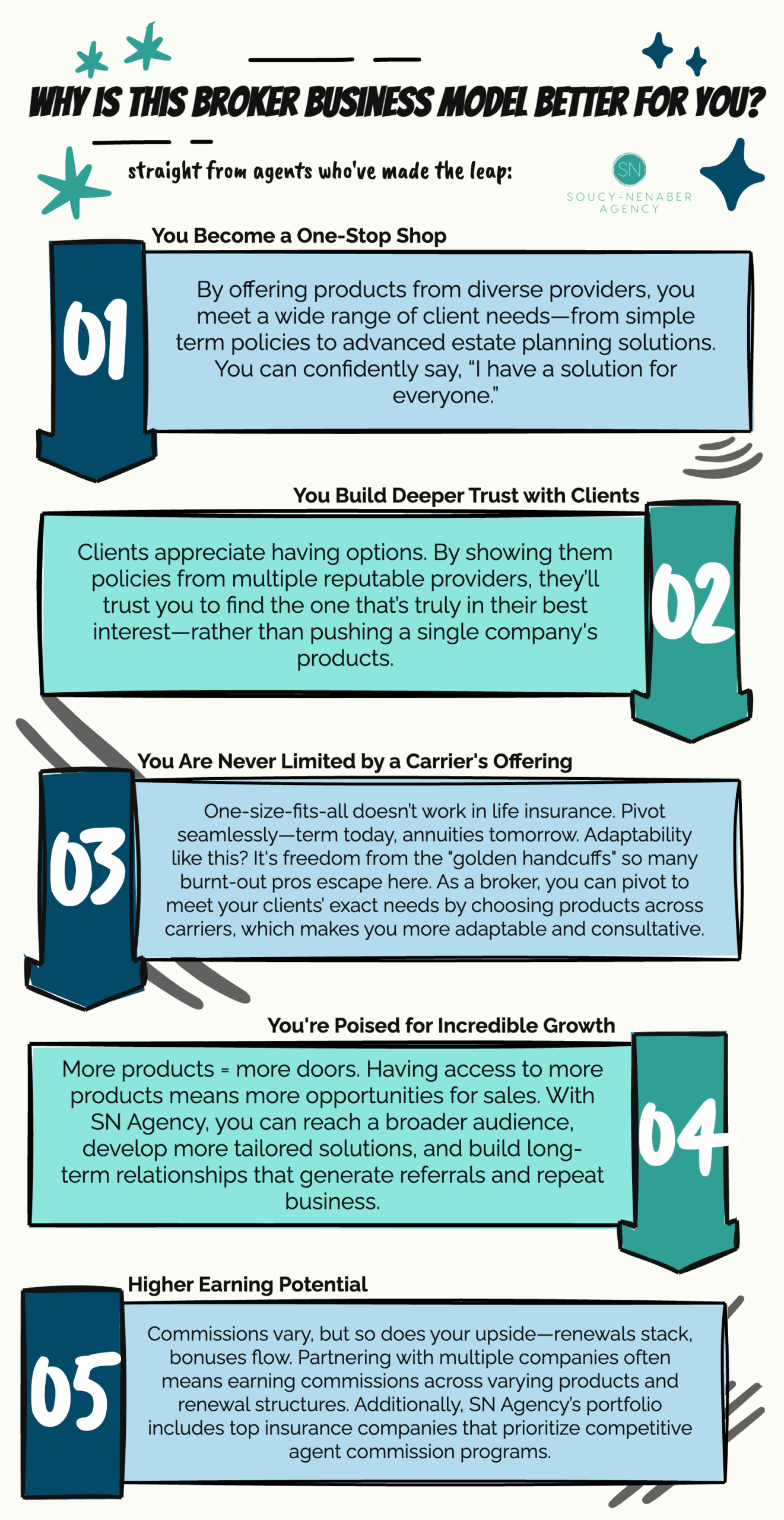

Let’s get real—why swap your current hustle for this? Because it’s not just better for clients; it’s a lifeline for you. Here’s the proof in the pudding, straight from agents who’ve made the leap:

1. You Become a One-Stop Shop

By offering products from diverse providers, you meet a wide range of client needs—from simple term policies to advanced estate planning solutions. You can confidently say, “I have a solution for everyone.”

2. You Build Deeper Trust with Clients

Clients appreciate having options. By showing them policies from multiple reputable providers, they’ll trust you to find the one that’s truly in their best interest—rather than pushing a single company’s products.

3. You Are Never Limited by a Carrier’s Offering

One-size-fits-all doesn’t work in life insurance. Pivot seamlessly—term today, annuities tomorrow. Adaptability like this? It’s freedom from the “golden handcuffs” so many burnt-out pros escape here. As a broker, you can pivot to meet your clients’ exact needs by choosing products across carriers, which makes you more adaptable and consultative.

4. You’re Poised for Incredible Growth

More products = more doors. Having access to more products means more opportunities for sales. With SN Agency, you can reach a broader audience, develop more tailored solutions, and build long-term relationships that generate referrals and repeat business.

5. Higher Earning Potential

Commissions vary, but so does your upside—renewals stack, bonuses flow. Partnering with multiple companies often means earning commissions across varying products and renewal structures. Additionally, SN Agency’s portfolio includes top insurance companies that prioritize competitive agent commission programs.

Bottom line? This model turns “What if I can’t?” into “Watch me.” It’s the shift from drained to driven.

SN Agency: Your Partner for Flexible Success

We didn’t start SN Agency to sell policies. We started it to spark change—for us, and now for you. Remember our story? No sales background, just heart and hustle. Today, we pour that into you: Top-notch training on everything from rapport-building to staying persistent in a shifting industry. Industry partnerships that fast-track your wins. And a culture? Empowering, not exhausting. Work from home, set your schedule, chase vacations without guilt. It’s the positive vibe our agents rave about—supportive, no toxicity, all growth.

Want to know if it’s your fit? Take our quick Life Insurance Agent Evaluation Quiz. Answer straight: Do you thrive on relationships? Crave flexibility over structure? Mostly A’s? You’re primed. (And hey, even B’s just mean you’re curious—like we were.)

Here’s Why Agents Love Working with SN Agency:

- Training and Mentorship: We provide training and ongoing support, ensuring you’re equipped to sell everything from term life to advanced wealth-preservation policies.

- Industry Partnerships: Access to a curated portfolio of top insurance companies, allowing you to close deals faster and grow more efficiently.

- Positive Work Culture: Unlike traditional agencies, we offer a flexible, empowering environment where you decide how, where, and when you work.

- Unlimited Growth Potential: With products from multiple carriers, you’ll have the ability to scale your business without limits.

Is SN Agency Right for You?

If you’re nodding—tired of limits, ready for freedom, financial independence, and that rush of making real impact—SN Agency is your launchpad. Sell from the top carriers, own your path, and build something lasting. We’ve got the tools, the team, and the belief in you.

👉 Ready to unlock those limitless opportunities? Click here to connect with SN Agency today. Let’s turn your “someday” into right now. You’ve got this—what’s your first step?

Freedom isn’t handed over. It’s claimed. Let’s claim yours together.

Click Here to Connect With SN Agency Today

If you’re ready to break free from cookie-cutter career models, SN Agency is the ideal partner. By offering products from leading companies like Mutual of Omaha, SBLI, Americo, and more, we empower you to run your business your way.

Stop settling for limits. Start building a career full of freedom, flexibility, and fulfillment—backed by the power of the industry’s best insurance providers.