Wondering about the pros and cons of selling life insurance— that blend of heart-pounding hustle and life-changing freedom that could finally pull you out of the 9-5 fog?

Or do you ever catch yourself mid-commute, gripping the wheel a little too tight, wondering if there’s a way out of this 9-5 fog—one where you call the shots, stack real income, and actually sleep knowing you’ve protected a family’s tomorrow?

Becoming a life insurance agent? It sounds equal parts thrill and terror, right? From the outside, it’s this glossy promise: uncapped earnings while handing out peace of mind like it’s your superpower. But peel back the layers, and it’s raw—the hustle, the heart, the “can I really do this?” whispers.

I’ve been there, friend. Ten years ago, I was charting IVs, not dreams. Now? I’m mentoring folks just like you—teachers, pros, even ex-athletes—who trade golden handcuffs for genuine freedom. Today, let’s unpack the shocking pros and cons of selling insurance and this wild ride, so you can see if it’s the door you’ve been knocking on. Stick around… your “yes” might be closer than it feels.

Weighing life insurance agent pros vs. cons? Get the real talk: uncapped income & family time freedom outweigh the hustle—for those ready to leap. Take our quiz and see if it’s your path to fulfillment. No golden handcuffs here.

Table of Contents: Pros and Cons of Selling Life Insurance

How to Decide if Selling Life Insurance is Right For You

Is life insurance a good career?

If selling life insurance is something you’ve been considering, make sure to do your research first in order to really decide if it’s the right fit for you! Pros include being able to work from home and the flexibility of setting your own hours.

Understanding customer needs and helping them secure a safer financial future through sound insurance choices is also part of this job – which could be incredibly rewarding.

On the other hand, there are cons such as inexperience potentially meaning a few losses at first, as well as difficulty with getting customers to see the full value of what you’re offering them.

All in all, when considering a new career, it’s important to weigh the pros and cons of selling life insurance before making any final decision.

How Do I Become a Life Insurance Agent? The Real Path to Owning Your Time and Making a Difference.

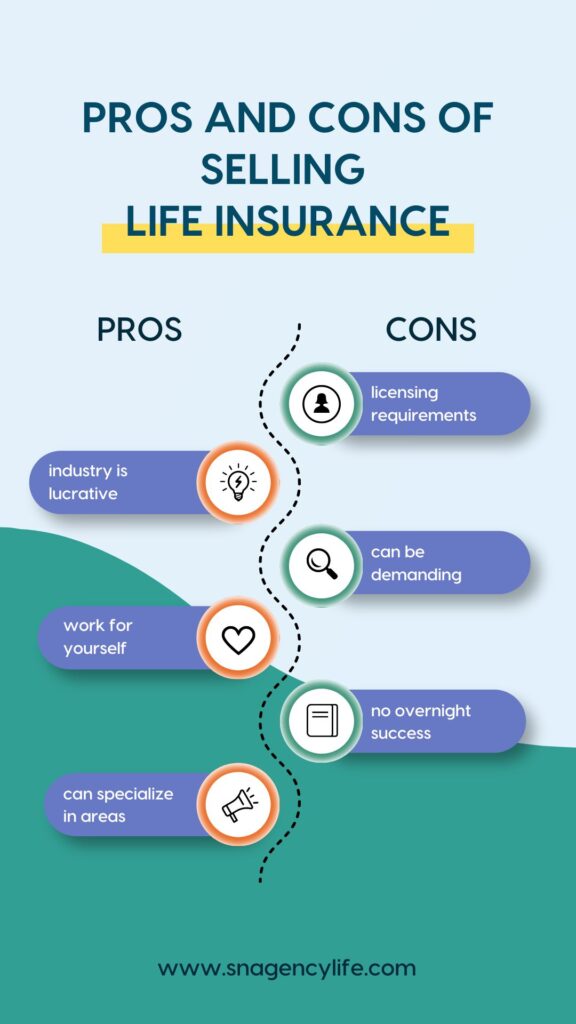

Let’s Break Down The 6 Pros and Cons of Selling Life Insurance.

3 Pros of Selling Life Insurance:

- The life insurance industry is competitive but lucrative.

- You have the option to work for yourself or someone else.

- You can specialize in areas such as annuities or group coverage.

3 Cons of Selling Life Insurance:

- There are licensing requirements that must be met before becoming an agent–so it’s important to take these into consideration when deciding if this career path is the right fit for you.

- Additionally, the life insurance industry can be demanding of your time.

- You may not make as much money as you would with a different job.

PRO – 1. The life insurance industry is competitive but lucrative.

Picture this: You’re stepping into a world that’s tough—like, no one’s handing you wins on a platter—but the payoff? Game-changing. I’ve watched agents go from scraping by to stacking commissions that fund family road trips, all because they’re in it for the long game.

Becoming a life insurance agent provides an exciting opportunity for ambitious professionals. Not only is the industry competitive and lucrative, but it can also create a rewarding career trajectory.

In order to take full advantage of this unique opportunity, agents must possess the essential skills including determination, knowledge of regulations, and great communication abilities.

There’s no denying that becoming a life insurance agent requires hard work and dedication; however, those who are up for the challenge will undoubtedly find tremendous rewards.

PRO – 2. You have the option to work for yourself or someone else

Ever felt that itch to call the shots, but the ‘what if I crash and burn’ whisper holds you back? That’s me, not too many years ago—tied to a schedule that owned me. Now? I choose my mornings with Cory and the kids, or dive into mentoring when the fire hits. You get both worlds here: solo freedom or the steady hand of a team like ours. Which pulls at you more?

Becoming an agent is a great career choice for the independent-minded worker. Owning your own agency gives you the freedom to control your affairs and be creative in the way you operate.

On the other hand, working for someone else as an agent provides with stability, steady earnings, and the potential to learn from industry veterans.

The great thing about being an agent is that you have both of these options at your fingertips, giving you autonomy over how you work and live. With careful planning and honed skills, becoming an agent can be a dream job with endless possibilities!

PRO – 3. You can specialize in areas such as annuities or group coverage.

Focusing on the nitty-gritty of annuities or the complex nuances of group policies can make you the authority in your field and set you apart from your run-of-the-mill competitors.

As an added bonus, this specialization opens up incredible networking opportunities that help boost your career.

Whether you are interested in more intimate client relationships or leveraging business contacts to find new outlets for your products and services, becoming an insurance agent offers something that few other industries are able to. And who says insurance has to be boring?

CON – 4. There are licensing requirements

Becoming a life insurance agent is an incredibly noble profession, and yet one that is not without its struggles. One of the potential cons is that there are requirements for licensing.

You will typically need to complete a number of classes, submit to a background check, pay fees for both testing and licensing, and then renew periodically.

It’s a lot of work, but it’s worth it if you want to be able to provide the life insurance policies that so many families need. Plus, once you make it through the process, you’re set for the next few years with minimal hassle!

5 Common Challenges For A New Life Insurance Agent.

CON – 5. The life insurance industry can be demanding

Becoming a life insurance agent isn’t always sunshine and roses. There are cons to consider such as the demanding nature of the industry – especially when dealing with strict regulations, navigating complex paperwork, and fielding inquiries from clients.

One thing is for certain though – if you approach this line of work with ambition and dedication, you will be on your way to financial success. And don’t forget that life insurance agents also play an important role in helping people secure their future – now that’s worth celebrating!

CON – 6. You may not make as much money as you would with a different job.

Becoming a life insurance agent certainly isn’t for the faint of heart – or those in it solely for the money. If you are determined to make a lot of money fast, this job won’t get you there.

It requires long hours, lots of follow-up and detailed work, as well as dedication and hard work to succeed. But that doesn’t mean financial success is completely out of reach – through experience and professionalism, an accomplished life insurance agent can find success and reap its rewards – just not overnight.

How to Get Started in the Life Insurance Industry

For those looking to break into the life insurance industry, it can be an intimidating process. However, taking the initiative and doing your research will give you a good start.

- Make sure you understand the basics of insurance and be aware of what specific regulations apply in your area, as these vary from state to state.

- Additionally, get connected within the industry. Ask people who have been involved in business for a while and attend industry events whenever possible. At SN Agency we host LIVE Zoom calls every week for anyone interested in a career with us. Watch a replay here!

- Networking is key when it comes to launching a successful career in this field – you never know who you might meet!

- Finally, using online resources available such as websites, forums, and blogs that discuss life insurance topics can also provide invaluable information about how to break into this field.

With a bit of dedication and hard work, you’ll get off on the right foot in no time!

What to Expect in Your First Few Months as a Life Insurance Agent

Joining a life insurance company as an agent for the first time can seem daunting, especially after just reading the pros and cons of selling life insurance. However, the foundation of success lies in taking each day step by step.

During your first few months, you will spend a great amount of time getting to know how various aspects of the job works, such as learning policies and procedures associated with managing clients.

Related Article >> The Truth About Being An Insurance Agent.

You’ll have plenty of opportunities to go out and talk to potential customers so you can coordinate and complete proposals. Of course, all this work leads to something even more important: commissions!

Even though you may start off small, with knowledge and practice, before you know it those numbers can be rising up faster than you ever could have imagined!

At the end of the day though, no matter what happens, having a strong support system is critical–not just your peers but also family and friends outside of work.

With dedication and perseverance, your first few months as a life insurance agent are sure to fly by; just keep your eye out for that impressive commission!

How to Grow Your Business and Become Successful in the Life Insurance Industry

I’ve stood where you are, staring at the what-ifs, and yeah, it’s scary… but the other side? It’s where mornings with your kids don’t feel like a negotiation.

Growing your business and becoming successful in the life insurance industry can seem intimidating, but it doesn’t have to be. With knowing the pros and cons of selling life insurance, it is important to weigh your personal situation before making this decision.

For those interested in becoming a life agent but do not know where to start, we’ve created an extensive resource page that you can review for more information on how to get started with your own business and the steps required to become licensed. START HERE!

Related Articles > How Agents Make This Work Without Being Pushy or Top Insurance Companies To Partner With As A Life Insurance Agent

We hope this article about the pros and cons of selling life insurance has been helpful! If you decide to become a life insurance agent after reviewing our resources sounds like something you would enjoy doing, be sure to ask us any questions about getting started today! This could be your pivot to purpose. Contact us!